Acquisition Focused on Accelerating FirstLight’s Continued Growth

FirstLight Fiber (“FirstLight”), a leading fiber-optic bandwidth infrastructure services provider operating in New York and Northern New England, announced today that it has entered into a definitive agreement to be acquired by Oak Hill Capital Partners (“Oak Hill”). Under the terms of the agreement, Oak Hill will acquire the company from its current private equity owner, Riverside Partners (“Riverside”). At the conclusion of the transaction, Riverside Partners is expected to continue as a minority investor in FirstLight.

“We have a great deal of respect for all that FirstLight has accomplished under the guidance of Riverside Partners. FirstLight has built an impressive fiber network and cultivated strong customer relationships and market presence throughout the northeast region,” said Benjy Diesbach, a Partner at Oak Hill. “We are excited to form this strong new partnership with Riverside Partners and the FirstLight management team.”

Scott Baker, a Partner at Oak Hill, added “FirstLight possesses all of the attractive characteristics and growth potential that Oak Hill seeks in our fiber investments. We see tremendous opportunity to create additional value by continuing to expand FirstLight’s fiber footprint while also pursuing acquisitions. We are delighted to join forces with FirstLight’s talented management team and with Riverside Partners to help drive this next phase of growth.”

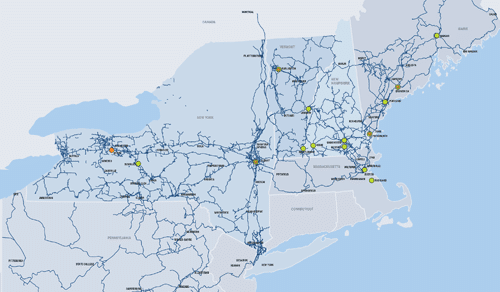

“FirstLight has been an exciting investment for Riverside Partners,” said Steven F. Kaplan, General Partner at Riverside Partners and Chairman of FirstLight’s Board of Directors. The Company started as an Albany, New York focused fiber provider and expanded through the acquisitions of segTEL in New Hampshire, TelJet in Vermont and G4 in New Hampshire. During Riverside’s investment period, FirstLight expanded its fiber route miles from 199 miles to over 2,500 miles and today operates a network of more than 260,000 fiber miles with over 2,000 on-net locations and 14,000 near-net buildings. “We are very proud of the accomplishments of our management team.”

“We are excited about the possibilities that this transaction creates for FirstLight and its customers. Oak Hill brings the expertise and financial resources necessary to accelerate FirstLight’s continued growth,” said Kurt Van Wagenen, President and Chief Executive Officer of FirstLight Fiber. “Through this relationship with Oak Hill, we will continue to expand our fiber network and service offerings while continuing to focus on providing the highest quality service to our customers.”

The transaction is expected to close in the third quarter of 2016, following the satisfaction of customary regulatory approvals. Financial terms of the transaction were not disclosed.

The Bank Street Group LLC served as FirstLight’s exclusive financial advisor in connection with this transaction. Choate Hall & Stewart served as legal counsel to FirstLight in connection with this transaction. Paul, Weiss, Rifkind, Wharton & Garrison LLP served as legal counsel to Oak Hill. TD Securities (USA) served as financial advisor to Oak Hill and is the left lead arranger of the debt financing with Citizens Bank, N.A. as joint lead arranger.