Combination further accelerates FirstLight’s position as one of the largest providers of fiber-based, high-capacity services throughout the Northeast

FirstLight, a leading fiber-optic bandwidth infrastructure services provider operating in the Northeast, announced today that it has entered into a definitive agreement to acquire 186 Communications (“186”).

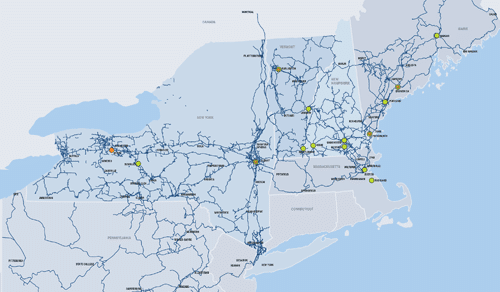

The transaction will combine 186’s high-capacity fiber network in Massachusetts, New Hampshire and Vermont with FirstLight’s expansive fiber network and complete portfolio of data, Internet, data center, cloud and voice services. Upon completion of this transaction, and FirstLight’s other pending acquisition of Finger Lakes Technologies Group, the company will operate approximately 14,000 route miles of high-capacity fiber-optic network connecting nearly 8,000 locations and twelve data centers across the Northeast.

186’s CEO Rob Carmichael said, “I am pleased that 186 Communications will be combined with FirstLight. The companies have collaborated many times over the years, and now as one organization, we will be better positioned to continue to serve the growing bandwidth needs of businesses throughout the Northeast.”

FirstLight’s President and CEO Kurt Van Wagenen said, “This is another exciting development for FirstLight. This acquisition is very complementary to FirstLight’s existing network and capabilities. It extends our network reach further into Massachusetts, New Hampshire and Vermont, adds an impressive roster of customers, and builds on the strong, positive momentum we have had over the past several years.”

Scott Baker and Benjy Diesbach, Partners at Oak Hill and members of the FirstLight Board of Directors, added, “This acquisition represents the next logical step in a series of strategic transactions that have dramatically transformed FirstLight into one of the largest fiber providers serving the IT infrastructure needs of carriers and business customers throughout the Northeast.”

Bank Street Group LLC served as exclusive financial advisor to 186, and Hinckley, Allen & Snyder LLP acted as legal counsel. Paul, Weiss, Rifkind, Wharton & Garrison LLP served as legal counsel to FirstLight and Oak Hill Capital Partners. The transaction is expected to close at the end of 2017, following the satisfaction of customary regulatory approvals. Financial terms of the transaction were not disclosed.